The margin calculator can also calculate other important values. The results: To open a EURUSD position with 0.1 lot, 1:100 leverage, and at the current market price, you will need a margin of 100.91 USD. Enter the Bid price or use the automatically inserted market price.Enter the Ask price or use the automatically inserted market price.Select the Currency in which the margin will be calculated (USD or EUR).For example, 0.1 (0.1 lot or 10 000 currency units). Enter the Lot size (the standard lot in Forex is equal to 100 000 currency units).Select the Instrument you want to trade – a currency pair, Gold, Oil, or another asset.

For example, let’s choose a Standard account. Select the Account type (Cent, Micro, Zero Spread, ECN, Crypto, or Standard).You can easily figure out how much money you need to open a position and thus build an effective trading strategy. The trading calculator calculates the required margin for each of your trades. Instead, you only need to pay a percentage of the position, which is called margin, and the broker lends the rest of the money.

#STOCK PROFIT CALCULATOR WITH LEVERAGW FULL#

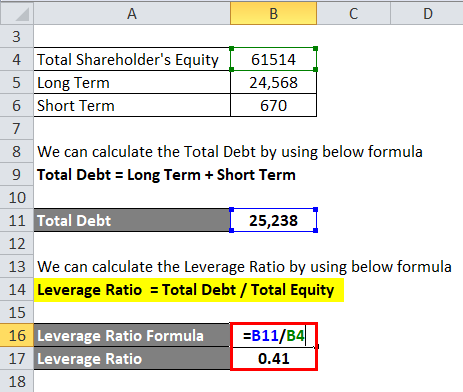

In other words, you don’t pay the full price of the trading asset. Margin trading - also known as buying on margin - is the practice of borrowing money from your broker to open a larger position than you could with your own capital. Results may vary depending on the data you provide when using the calculator. The risk is greater than the return, so it is important to use caution when using leverage.Disclaimer: Calculations made in the trading calculator are for informative purposes only and should not be taken as trading advice. It can increase the amount of money you have to invest, but it can also lead to a larger loss. This is also known as margin trading and involves borrowing money in order to invest in a larger amount of stock than you have on hand. Leverage is a common practice in the stock market. In this case, you can trade up to $6,000 worth of stock for twenty dollars. For example, if you start with a $25,000 account, you ll need to deposit $5,000 of marginable securities to open a long stock position worth $9,000 with a margin rate of 30%. In some cases, the initial margin requirement is lower than the maximum loan amount. Therefore, you ll need to calculate the total cost of borrowing to enter a trade, as well as the profit or loss of that trade.

However, it s important to remember that you don t have to put up the full amount of an asset to make a trade. In certain cases, it can help traders gain access to certain asset values that they otherwise would not otherwise be able to access. When used correctly, trading on margin can be a profitable venture. Here are some tips that can help you decipher the trading calculator. Beginner traders may need an explanation of the calculations to better understand the information. To use this tool, enter your account currency, the amount of leverage you need, and the amount of your transaction parameters. The RoboForex Calculator gives you leverage values of up to 1:2000. This is important because the brokerage firm can force you to sell your holdings if you don t meet the requirements in a timely manner. The tool will also let you know when you need to make a deposit or sell your holdings. It s helpful to have an online stock margin calculator to keep track of the amount of margin you need for each position. The margin requirement is different for each security and will vary by broker. To use a stock leverage calculator, you need a Portfolio Margin account with a minimum amount of 100000. This tool is also important for calculating the The Diary of a Forex Trader of risk you can take on a given stock. The tool will descargar metatrader 4 ig,login,xmglobal,xm global you your current margin balance and how much you need to invest for each hypothetical transaction. A stock leverage calculator is a tool that helps you figure out how much margin you need to maintain a position in a stock.

0 kommentar(er)

0 kommentar(er)